Analysis of the performance of 44 lighting enterprises in 2023: the trend of the lighting market continues to improve.

sourcewww.lightingchina.com.cn

time2024/05/06

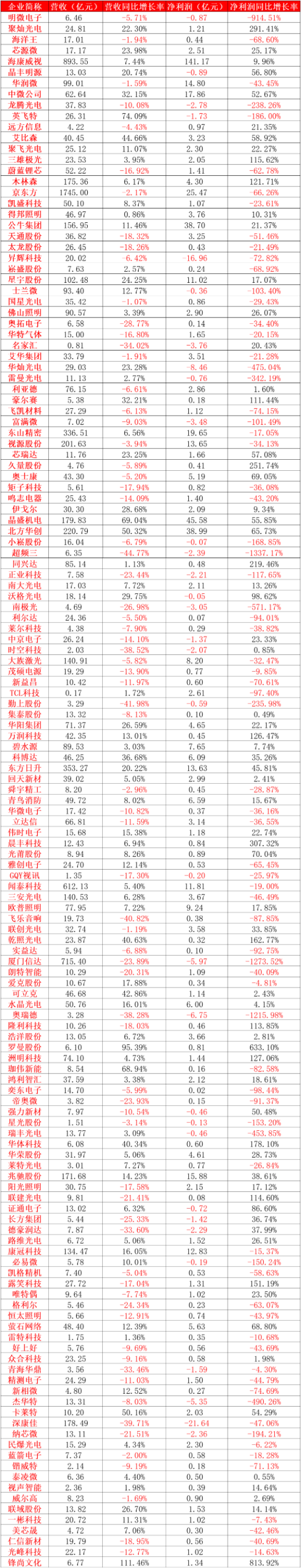

- As of May 2nd, approximately 144 listed LED/lighting enterprises nationwide have released their performance for the year 2023

2023 performance data for the 144 listed LED/lighting enterprises

As of May 2nd, approximately 144 listed LED/lighting enterprises nationwide have released their performance for the year 2023.

The statistical data indicates that among the 144 listed LED lighting enterprises, 72 have achieved year-on-year revenue growth, and 69 have achieved year-on-year net profit growth, accounting for approximately 50.00% and 47.92% of the total respectively.

Among them, 50 companies including Ledvance Lighting, Bull Group, and Zhaochi Share have achieved double-digit growth in both revenue and net profit, accounting for around 34.72% of the total. Furthermore, it is noteworthy that 12 companies such as Haurui, Huati Technology, and Wanrun Technology have managed to turn their performance from loss to profit.

Looking at the overall performance of listed LED/lighting enterprises nationwide in 2023, the number of companies with year-on-year growth in both revenue and net profit, as well as those with double-digit growth in revenue and net profit, are approximately 4-5 percentage points higher than the first three quarters of 2023.

Additionally, the number of companies turning losses into profits is 5 more than the first three quarters of 2023, indicating a clear recovery trend in the industry.

So, what are the factors driving the continued improvement in the overall performance of listed LED/lighting enterprises?

Zhongzhao Network will showcase and discuss these factors one by one, in the hope of providing experiences and references for listed LED lighting enterprises that are still struggling to overcome market challenges.

The market for finished goods has returned to normalcy.

During the three years of the epidemic, the market channels for portable lighting fixtures and LED display products for home, commercial, and other public uses were disrupted due to regional and logistics controls, leading to manufacturing enterprises in this category struggling to achieve revenue growth. In early 2023, with the implementation of the "New Ten Measures" for epidemic control, the market sales channels for portable products gradually reopened, and some downstream enterprises in the LED/lighting industry chain began to experience a surge in revenue growth.

Throughout 2023, about 16 listed LED/lighting finished product manufacturing companies such as Foshan Lighting, OPPLE Lighting, Lianyu Shares, Guangpu Shares, and Edison achieved a double-digit increase in profit compared to the previous year; companies like Leyard, Sunshine Lighting, and Lianjian Optoelectronics, although did not achieve revenue growth, also saw varying degrees of year-on-year increase in net profit. Among them, companies like Sanxing Aurora, Zhouding Technology, and Jiuliang Shares achieved a net profit growth of over 100% year-on-year.

Of particular note is that many listed LED/lighting finished product manufacturing companies that achieved revenue growth in 2023 were driven by the overseas market.

For example, the overseas income gross profit margin of Huarong Shares in 2023 increased by 7.17 percentage points year-on-year, which is about 50% higher than the 3.97 percentage points increase in the gross profit margin of domestic income year-on-year; Lianyu Shares also mentioned in their annual performance report that their overseas revenue in 2023 amounted to 1.317 billion yuan, accounting for as high as 95.31%.

It is evident that the overseas business of listed LED/lighting finished product manufacturing companies played a significant role in driving their revenue growth.

The cultural tourism night-time economy is booming in the post-pandemic era.

Four years ago, the sudden onset of the pandemic pressed the pause button on the national cultural and tourism night tour industry. With the lifting of crowd restrictions in early 2023, the cultural and tourism night tour industry gradually returned to normal. The pent-up emotions of the general public, suppressed by the epidemic for three years, urgently needed to be released through travel experiences, enabling the cultural and tourism night tour industry to achieve an explosive growth, driving listed LED/lighting enterprises in the lighting engineering ecosystem to achieve annual performance growth.

In the field of cultural and tourism, where light design and creative planning are interpreted, Fengshang Culture achieved a explosive performance improvement with revenue growth exceeding 100% year-on-year and net profit growth exceeding 800% year-on-year. Factors such as retaliatory travel by tourists, the enhancement of cultural and tourism consumption, innovation in cultural and tourism supply optimization, and the continuous repair of the cultural and tourism industry supply chain are the main objective and subjective favorable factors contributing to the company's explosive performance growth.

In the field of lighting engineering, Romon Group not only turned losses into profits, but also achieved double-digit growth in revenue and profits year-on-year. The company fully utilized the recovery of cultural and tourism to drive the warming demand for landscape lighting during the reporting period, seizing the era of opportunities for immersive night tours to create new urban nighttime cultural and tourism economic scenes and new dynamics, rapidly advancing the nationwide layout of landscape lighting business, and deeply integrating urban lighting, digital cultural tourism, and intelligent new energy to achieve rapid growth in annual performance.

In the field of lighting product manufacturing, the leading national stock in stage lighting - Haoyang Group, achieved respective year-on-year revenue growth of 7.29% and 8.03% for performance lighting equipment and stage entertainment lighting equipment, contributing to its double-digit growth in annual performance. These two types of products account for over 90% of the company's operating income, demonstrating the significant impact of the recovery and explosive growth of cultural and tourism night tour products on its performance and revenue growth.

The new track market dividend is gradually being unleashed.

In recent years, with the advent of the boom in the promotion of green energy, the construction of smart cities and urban renewal, the upgrading of the automotive industry, and other social welfare facilities and industrial transformations, it has driven the nationwide LED/lighting enterprises to embark on strategic transformations and expand their core businesses horizontally across different fields and even into new territories.

In 2023, several listed LED/lighting enterprises reaped significant market dividends in the "new track" of their operations; some even managed to reverse their declining trends by venturing into these new business avenues when revenues from LED/lighting businesses were no longer sustainable.

In the field of new energy, companies such as Haursa, Mulinsen, Igor, Chenfeng Technology, and Dongfang Risheng achieved annual performance results in areas such as heavy-duty electric vehicle charging, battery asset management, photovoltaic energy storage, photovoltaic inverters, charging piles, wind farms, photovoltaic power plants, and solar cells. Among them, Igor, a lighting driver power supply manufacturer, achieved a year-on-year growth of 42.32% in energy product revenue despite a 4.60% decline in lighting product revenue, which helped them achieve a double increase in annual profits.

In the realm of smart city construction, companies like Huati Technology, Haursa, Roman Shares, Mingjiahui, and Space-Time Technology also achieved commendable annual performance results. For example, Mingjiahui achieved a slight increase in annual net profit year-on-year despite a 54.59% decrease in nighttime economy business revenue, thanks to a 292.32% increase in smart city business revenue. Huati Technology, on the other hand, achieved a significant year-on-year increase of 437.59% in revenue from services such as program planning and design, urban operations management and maintenance, and contract energy management, in addition to a 12.38% growth in product sales revenue through comprehensive investments in smart city construction.

Furthermore, in the field of automotive lighting, whether it is Xingyu Shares, Debao Lighting, Foshan Lighting, or Hongli Zhihui, Keboda, Jufei Optoelectronics, Huayang Group, Weishi Electronics, and many other midstream and downstream product manufacturers in the automotive chip, light source, controller, and display device industry chains achieved double-digit annual profit growth.

Although the overall performance of domestic listed LED/lighting enterprises in 2023 continued to improve, with over half of the companies still unable to achieve year-on-year growth in net profit and 32 companies still in a loss-making state, the national LED/lighting market has yet to return to its pre-pandemic prosperity.

Looking ahead to the upcoming year of 2024, the national lighting industry is eagerly anticipating more listed LED/lighting companies that did not meet performance standards in the previous year to reverse their declining trends. This will not only instill confidence in industry investors but also contribute stronger capital power to the industry's high-quality and innovative development.